Preface: “Go Roth, young man!” – paraphrasing Horace Greeley

History of the Retirement Plan, Part III

The following is the third in a series of blog posts on the subject of retirement plans. The first two installments can be found here and here. In them we have:

-

- Briefly reviewed the history of government-defined retirement models in the United States,

- Introduced the tax-deferred model,

- Explained the difference between Qualified plans and Individual Retirement Accounts (IRAs).

- Discussed limits to deductibility of retirement contributions, and also

- Tax treatment of non-deductible contributions.

In this third installment, we introduce:

The Roth model

The Story so Far

We have already seen how the Employee Retirement Income Security Act (ERISA) of 1974 introduced the tax-deferred model of retirement savings, including two kinds of tax-deferred accounts: job-based Qualified plans and Individual Retirement Accounts (IRAs). Contributions to these accounts are generally tax-deductible. Withdrawals are then taxed as ordinary income when withdrawn after retirement age is reached.

We have also seen how the government got cold feet about allowing taxpayers to deduct the full amount of their IRA contributions. This led to a complex situation in which the tax status of money within an IRA has to be tracked so that a taxability percentage can be computed upon withdrawal.

Enter Roth

Perhaps because of the complexities of having to track IRAs that contain both pre- and after-tax money, or perhaps because the government realized that they kind of liked the idea of taxing money when it was contributed instead of having to wait until people retired, the Taxpayer Relief Act of 1997 included a proposal that had been submitted by Senators William Roth of Delaware and Bob Packwood of Oregon. Perhaps because Roth’s was the shorter name, this new kind of account came to be named after him and not after Senator Packwood.

The main innovation of the Roth IRA is that all contributions have to be included in taxable income in the year they are contributed. No amount may be excluded or deducted. As a result, all money in a Roth IRA has an after-tax status.

Once the Roth IRA came into existence, the older kind of IRA came to be known as a “traditional IRA”. The two types of IRA are often contrasted as one where you pay taxes now vs. one where you pay taxes later. But the difference between the two models is far greater than just the timing of taxation.

Would you believe me if I told you that earnings on Roth contributions are never taxed? Well, it’s true. Really. NEVER. EVER. Not only that, but you don’t even have to report them. Once after-tax money is contributed to a Roth, you can keep growing and investing it in a parallel universe where taxes don’t exist.

Here is a schematic view:

The Case for Roth

The previous post in this series made the point that unless your time remaining to retirement is very short, the value of your IRA by retirement will likely be more than twice the amount of your total contributions. Therefore, even if you cannot deduct your IRA contributions, it is still worth contributing and paying the “higher rate” now so you can get the “lower rate” on the withdrawal of the earnings. How much more so is this then true of Roth IRAs, where the “lower rate” paid on withdrawals is always zero.

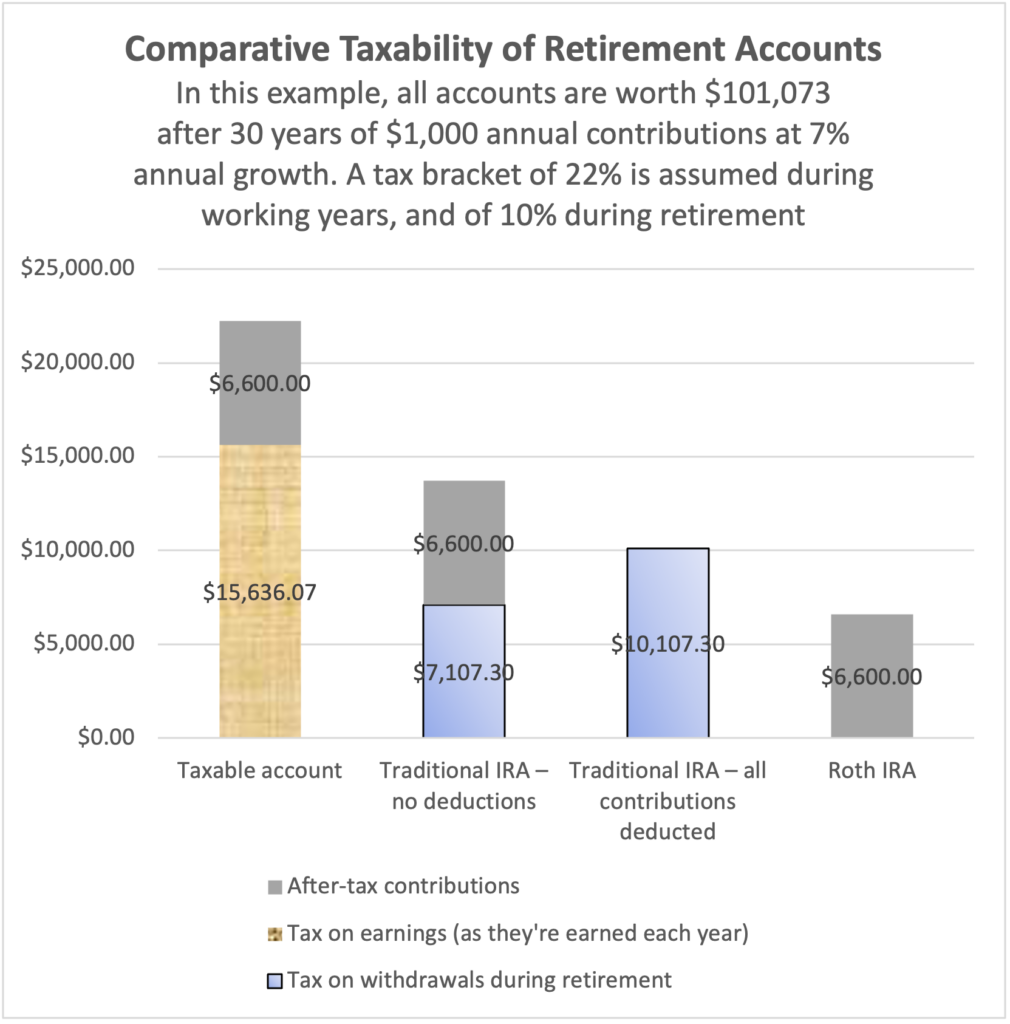

Let’s consider a conservative example of someone who contributes $1,000 a year for 30 years at a growth rate of 7% a year. This is a conservative assumption since between 1995-2025 the S&P 500 has averaged better than 10% a year. But even at 7%, you would more than triple your money with an ending balance of $101,073 after 30 years of contributing $1,000 per year.

Let’s assume a taxpayer who is in the 22% tax bracket while working and in the 10% tax bracket during retirement.

If this were a taxable account, your contributions would be made from after-tax money, corresponding to $6,600 ($1000 x 30 x 22%) in income tax paid on 30 years of contributions. In addition to this, tax would be due on the earnings that grew in the account each year. Taxed at your marginal rate, this would total $15,636.07 (($101,073 – $30,000) x 22%) paid as it is earned. In reality, tax on earnings might be slightly less because some of it would likely be eligible for the lower rate on qualified dividends and long-term capital gains.

If the account were a traditional IRA with no deductions taken, you would have paid the same $6,600 on contributions as with the taxable account. The earnings, however, would be taxed at the lower rate as they’re withdrawn during retirement: a total of $7,107.30 (($101,073 – $30,000) x 10%).

If the account were a traditional IRA with all possible deductions, the only tax paid would be on withdrawals during retirement: a total of $10,107.30 ($101,073 x 10%).

If this were a Roth IRA, you would pay nothing on earnings and nothing at withdrawal. The only tax involved would be that same $6,600 you paid on income that you used to make the contributions over 30 years.

Here is a graphic view:

Of course, the numbers here are arbitrary, but the dynamics should be clear. As your time horizon is longer and your annual contributions and percent growth are larger, these differences become more pronounced.

If you expect to retire into poverty to the extent that you will never be subject to tax on withdrawals from your IRA, then by all means open a traditional IRA so you can at least deduct some of your contributions. But if you expect to have taxable income in retirement, and especially if you can begin saving early in life, you are almost certainly better off with a Roth. And you are almost certainly better off contributing the maximum allowed to your Roth each year.

In the spirit of manifest destiny and the Homestead Act of 1862, we might even say: “Go Roth, young man, and grow up with your tax-free earnings!”

When considering the annual limit on contributions to IRAs, note that contributions to Roth IRAs are included for this purpose. You may contribute to any number of traditional and Roth IRA accounts in the same year, but total contributions may not exceed the annual limit, which is $7,000 in 2025 for taxpayers under 50.

Another advantage of the Roth is that because there is no tax after you retire, there is no required minimum distribution either.

The Roth Legacy

Not everyone will be won over by the mathematical arguments that favor the Roth IRA over the tax-deferred “traditional” IRA. But consider that since the introduction of Roth in 1997, its influence has only been growing, while “traditional” becomes more of a circumscribed concept.

Newer types of tax-advantaged savings vehicles such as 529 college plans, first introduced in the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), work according to the Roth model. Contributions are not deductible, but earnings are never taxed if the money is used for qualified purposes. This is essentially a Roth-type plan. The only difference is that the qualified purpose of a 529 account is education, not retirement. The only reason no one talks about a “Roth 529” is that there is no such thing as non-Roth 529.

Even Qualified plans available through employers are showing up in Roth variations. Many companies now offer a Roth 401(k). As you can imagine, this is just like a “traditional” 401(k) except that the contribution is not excluded from taxable income and the earnings are tax-free if not withdrawn before retirement.

Even state-employers are getting in on the Roth model and offering Roth-type Qualified plans for state employees. The general term for these is “Roth-designated accounts”. A “Roth-designated” portion of an account will work just like the non-Roth part except that the contributions are not excluded from taxable income and the earnings are tax-free if used for qualified purposes.

Rollovers and conversions between all these types of accounts should follow the same general principles as for more well-established types of account. There is as of yet not a lot of documentation on every possible type of rollover or conversion.

In the next post in this series, we will review conversions from traditional IRAs to Roth IRAs (“Roth conversions”).

![]()